Tesla’s shareholder vote on Elon Musk’s pay is in some ways a referendum on the performance of the company and its chief executive.

Late on Wednesday, Mr Musk claimed victory in a social media post, saying votes in favor of his pay package were leading by a “wide margin”, giving Tesla shares a boost. But even before the official results are announced on Thursday, Tesla’s share price shows that investors have plenty of doubts about Mr. Musk and the electric car maker’s prospects.

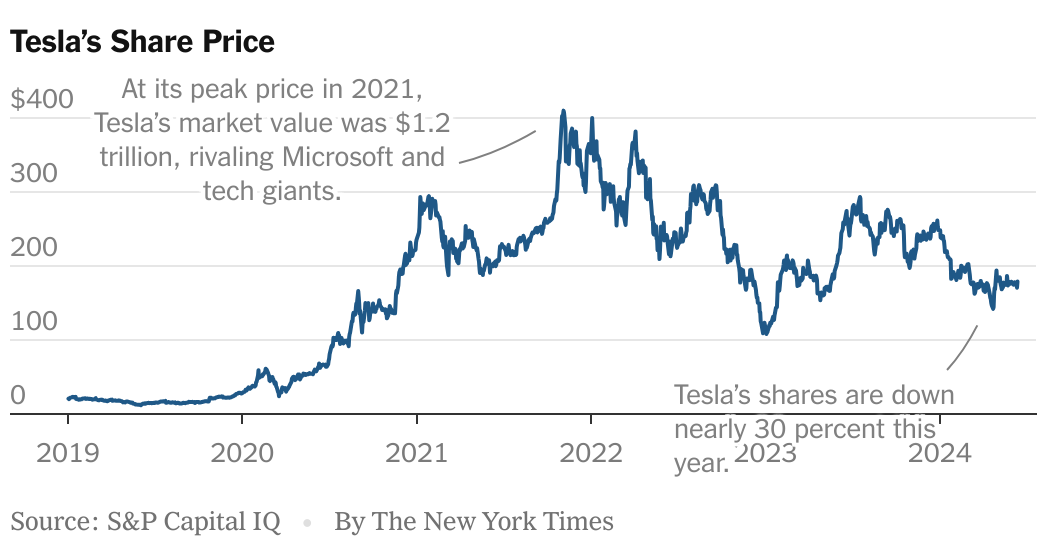

Tesla shares are down nearly 30 percent this year, even as the broader stock market is up 14 percent. At its peak in 2021, Tesla’s stock market value was $1.2 trillion, putting it in the company of tech giants like Microsoft, Apple and Google. Its value has since sunk to about $576 billion, ranking it alongside less sleazy companies like Visa and Walmart.

Blame concerns about Tesla’s business.

The company is facing tougher competition and although its flagship models have sold extremely well, demand for them appears to be falling. Price cuts aimed at stimulating interest are eroding profit margins. And analysts say there are no new models coming soon that could prompt another wave of buying.

“They’ve really struggled to grow,” said Toni Sacconaghi, an equity analyst at Bernstein who covers Tesla. “And part of the reason they’ve struggled to grow is that they don’t have new models.”

Tesla’s first-quarter profit fell 55 percent to $1.1 billion from a year earlier, while revenue fell 9 percent to $21.3 billion. The company revealed plans to lay off 10 percent of its workforce, or 14,000 people.

Investors may also avoid Tesla stock because they think it’s overvalued. Its price is about 50 times the earnings per share that analysts expect Tesla to generate next year. The broader stock market trades at a much lower multiple – 20 times.

But some analysts still recommend buying the stock because they expect Tesla’s growth to return when it eventually releases a lower-cost electric vehicle. “They still have significant volume growth ahead of them,” said Garrett Nelson, who covers Tesla for CFRA.

Mr. Nelson said he also expected Tesla to earn more from selling software that was designed to help Tesla owners drive their cars. And some on Wall Street hope Tesla will one day follow through on its plan to build a large fleet of self-driving taxis. Ark Invest, an investment firm led by Cathie Wood, a longtime Tesla fan, believes the so-called robotax could push Tesla shares to $2,600, nearly 15 times their current value.

Tesla’s current displeasure is quite different from the intense bullishness that sent its stock on a meteoric rally and enabled Mr. Musk to acquire all of the stock options at the voting price.

Shareholders approved the pay package in 2018, but a Delaware judge struck it down in January on the grounds that, among other things, Mr. Musk had effectively overseen his own compensation plan. Tesla hopes that if shareholders again support the package, the court will reinstate it. Some big investors say they will vote against the pay deal, currently worth about $45 billion, because it’s too big

The drop in Tesla shares points to a flaw in pay packages that rely on stock price performance: executives typically don’t have to pay back pay if the stock falls below the price at which they earned it.

Tesla’s stock market value is now at a level that would have failed to qualify Mr Musk for a share of the package. But he has to keep it because the market value hit the targets within the time specified in the package.

Mr Musk’s actions may also have weighed on Tesla shares.

In 2021 and 2022, he sold about $38 billion in Tesla stock to help finance his acquisition of Twitter, now called X. His Tesla stake, once about 30 percent, is now 13 percent without the shares based on the 2018 package and 20 percent with it.

Mr. Musk has said he would like a 25 percent stake. “It’s not so much that I can control the company even if I’m cheated,” he said in January. “But it’s enough that I have a strong influence.”

Mr. Musk and Tesla’s press department did not respond to a request for comment.

A pressing question is whether Tesla’s shares could fall if Mr. Musk loses the vote on the pay package. Investors can sell if they believe he is crucial to the company’s future. But because so much of his wealth is in Tesla, Mr. Musk may see little reason to lose.

Mr. Sacconaghi asked him on an investor call in April if he was considering reducing his involvement in Tesla. “I have to make sure that Tesla is very prosperous,” Mr. Musk said.